I don’t normally read the newspaper, but given that it has been delivered to my hotel room every morning for the last week, I’ve taken the opportunity to glance through it each morning.

I also do not normally watch television (we do not get cable and really don’t get much by way of local channels), so I have had the opportunity to watch the network news each evening. Like the newspaper, I find the network reports mostly depressing. The Democratic Convention has consumed most of the programs I’ve had the chance to watch and it is of very little interest to me. The USA Today is not much better, but there were a number of articles I found particularly interesting (and disturbing) yesterday.

“

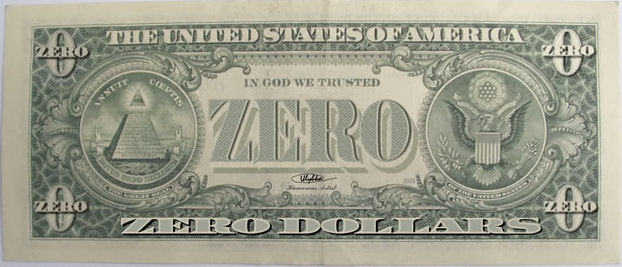

Highest wholesale inflation pace in 27 years? I’m surprised this actually made the news; apparently I need to read the paper more often. Perhaps if people are aware of just how bad the situation is, they might start asking why inflation is such a problem.

“..rising bank failures are eating into the FDIC’s Deposit Insurance Fund, which reimburses depositors. In the second quarter, its balance fell to $45.2 billion, down 14% from the first quarter. To boost fund assets, the FDIC said it’s considering raising banks premiums for deposit insurance, with troubled banks paying more because of the higher risk of failure.”

I can only imagine what increasing premiums for failing banks is going to do for those failing banks – but then, what else is the FDIC supposed to do. Why not have the Federal government bail them out? That way we could continue socializing the losses, but maintain privatization of the gains! I could get a second job to help out.

“The credit crisis took a heavier toll on banks in the second quarter of the year: the number of troubled banks rose 30%, to 117, the highest in 5 years, from

The article later went on to say that roughly 8% of the troubled banks on that list end up folding. That’s a lot of lost savings – fractional reserve banking at its finest.

“The oldest baby boomers are turning 62 this year, making them eligible for Social Security, about half, or 1.6 million, are expected to file for Social Security as soon as they qualify…”

I’ve pointed this out before – the BBs constitute a liability more than 5 times our National deficit. We cannot currently pay the interest on our debt. How do we pay the interest on a debt 5 times what we currently owe? That would amount to over a $500,000 contribution for every household in the Nation.

It would be interesting if these topics were discussed by the current political candidates.